Assessment Tax In Malay

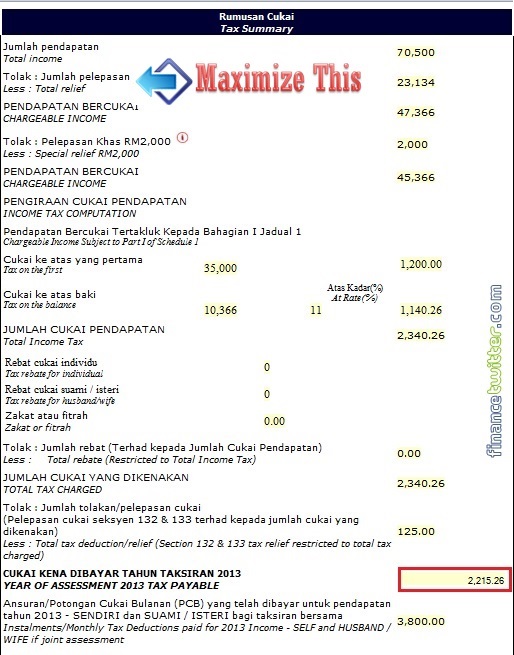

If you re still in the dark here s our complete guide to filing your income taxes in malaysia 2020 for the year of assessment ya 2019.

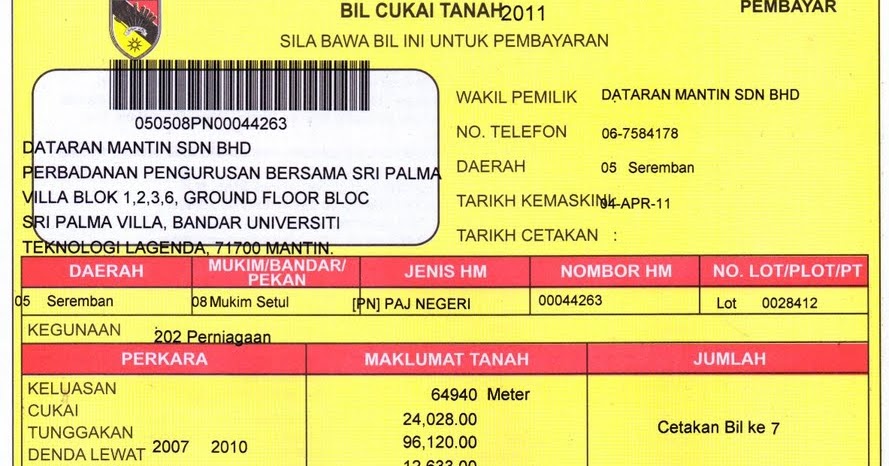

Assessment tax in malay. So what is cukai taksiran. It s a tax based on the rental value of a property paid by the owner. Cukai taksiran is a tax that is charged to all property or land owners by local district city halls. The amount of an annual assessment tax hinges on the value of the property which the state determines in most cases by the amount of rent paid on the property during the course of a year.

Malaysia s taxes are assessed on a current year basis and are under the self assessment system for all taxpayers. That said income of any person. Who needs to pay income tax. Pos malaysia is malaysia s largest network courier with over 200 years of service.

All income accrued in derived from or remitted to malaysia is liable to tax. It s paid to the local authorities who set their own rate but it s most often around 4 of the rental value. Information about the property taxes assessment tax quit rent stamp duty and real property gains tax paid by home owners and tenants in malaysia. Assessment tax quit rent pos malaysia.

This tax is known in malaysia as cukai pintu. Assessment tax is a tax imposed on all ownerships and ratable properties that are within the administrative areas of shah alam city council mbsa. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Local councils in each malaysian state levy assessment tax against those who provide residential housing units.

The act power to impose the assessment tax is in accordance with the provisions of the local government act 1976 act 171 under section 127 that allows shah alam city council to impose rates on the ownerships that are within the administrative. Track trace your parcels calculate postage prices find a postcode and more.