Capital Allowance Rate Malaysia

6 2015 date of publication.

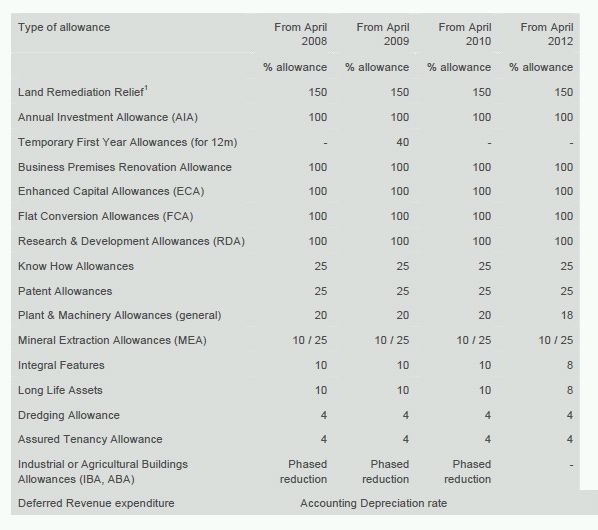

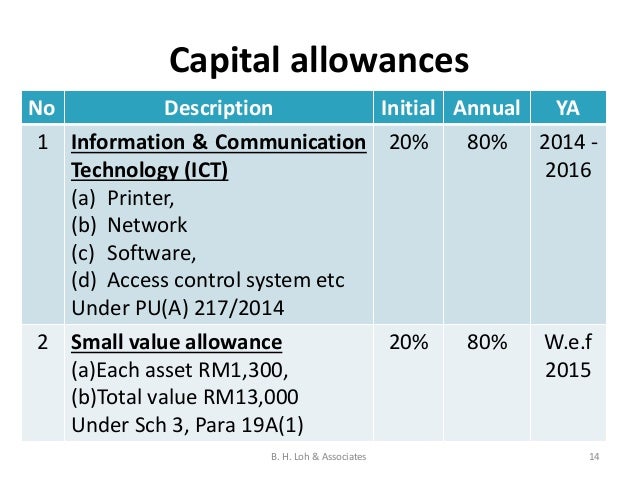

Capital allowance rate malaysia. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. 155 last update. Types and rate of capital allowance are as follows. Approval for exemption relief.

75 of the cost incurred to be written off in the first year i e. The rates of accelerated capital allowance allowed are as follows. 7 2018 date of publication. Malaysia is taxed at the rate of 15 on income from an employment with a.

27 august 2015 page 6 of 22 47 1 12 ia rm 23 8 2 0 x 20 4 76 4 aa rm 62 64 0 x 20 12 5 28 17 292 residual e xpenditure 29 8 2 0. Inland revenue board of malaysia accelerate capital allowance public ruling no. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f.

All types of assets. Related provisions 1 3. 2020 02 25 08 38 26 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. No deferment of capital allowance claim is allowed under this option.

Standard rates of allowances under schedule 3 of ita 1967 4 7. And 25 of the cost incurred to be written off in the second year i e. Capital allowance 3 5. 15 april 2013 contents page 1.

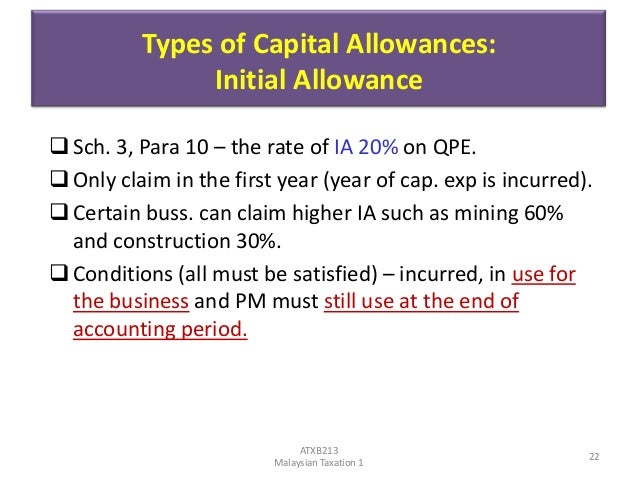

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business. Allowance or deduction is published in the gazette. 4 2013 date of issue.

8 oktober 2018 inland revenue board of malaysia page 2 of 19 4 3 the conditions that must be fulfilled by a person to qualify for an initial allowance ia and an annual allowance aa are the same as the conditions to claim capital allowances at the normal rate under schedule. Capital allowances tax incentives income exempt from tax double tax treaties and withholding tax. Claiming capital allowances capital expenditure incurred by a person carrying on a trade profession or business on the provision of plant and machinery for purposes of the trade profession or business can qualify for capital allowances claim. Capital allowances consist of an initial allowance and annual allowance.

Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Inland revenue board of malaysia computation of capital allowances public ruling no. Capital allowances are generally granted in place of depreciation which is not deductible.

.jpg)